—-

To stay in the loop with the latest features, news and interviews from the creative community around licensing, sign up to our weekly newsletter here

With Q4 upon us, Licensing Ltd’s Paul Bufton, Start Licensing’s Ian Downes, The Brand Director’s Tim Collins and Aardman’s Ben Townsend reflect on the year’s trends – and what’s next.

Paul Bufton, Founder, Licensing Ltd

As we enter the Q4 selling season, it’s an interesting time to reflect on 2025 and emerging trends. The area that stands out for me is wellness. Admittedly it’s a very broad term and tends to be a bit of a ‘catch all’, but I think it’s reflective of consumers wanting to take better care of themselves – physically, mentally and spiritually.

We’ve seen some interesting collabs this year in the sports nutrition space, like Deadpool x Myprotein and Optimum Nutrition’s relationship with Lauren James of Chelsea and England fame. It’s clear this will continue to evolve and grow with increased participation in sport and more education about nutrition and its long-term benefits.

From a mental health point of view, Calm has been groundbreaking in their approach to partnerships thanks to the positive influence of its founder Michael Acton-Smith and the recent on-boarding of industry legend Joe Lawson. One of my favourite activations was the partnership with Mars on their pet food brands, reinforcing the connection between good mental health and pet ownership.

In terms of the future, and as I gaze into my crystal ball, I’m getting a sense that wellness will also extend into a more spiritual place. There’s an increasing interest – especially in the younger generations – in crystal healing, sound baths, tarot and manifesting one’s destiny… It’s only a matter of time before this becomes more of a mainstream trend and you heard it first from Psychic Paul!

Ian Downes, Director, Start Licensing

I think there’s a growing movement towards authenticity in licensing generally and design. There’s greater recognition that products and design that are closely aligned to the featured IP will perform better. This manifests in a range of ways, including use of specific design assets and images, right through to companies researching brands more forensically to identify details that make a finished product more authentic. This all plays into a recognition that licensed products can help tell brand stories and enhance the fan experience.

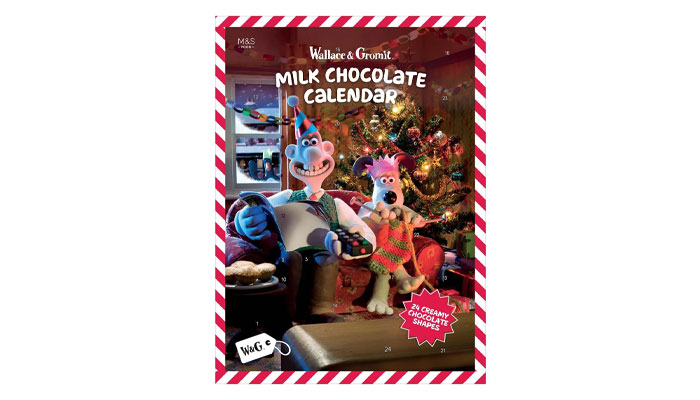

And looking at Q4, I would highlight the food and drink category. There are seemingly more interesting licensing-led collaborations in the sector and Christmas is always important for the composite gift category, where brands like Costa Coffee feature. There’s also a boost for classic products like chocolate advent calendars – this year M&S launched a Wallace & Gromit Advent Calendar for example.

Beyond this, we’re increasingly seeing engaging FMCG products forged from a licensing starting point. A good example of this is the recent partnership between drinks brand Bailey’s and Terry’s Chocolate Orange – the resulting product seems to be a most apt one for seasonal celebrations. One of the explanations for the increase in licensing ‘collabs’ in FMCG is that they deliver quicker NPD and innovation, plus provide lots of ammunition for engaging social media content.

Tim Collins, MD, The Brand Director

This year, I loved the LEGO Botanicals range. It’s a complete contrast to their more typical product themes and something that taps into a largely adult female customer group that would probably not buy into their usual fare.

Trend-wise, I also see the onward growth of motorsports licensing, especially in F1. McLaren have done a great job with their collaborations with the likes of Puma, Reiss and Levi’s, and Williams have done well with fashion and LEGO products. This shows the sport leaning into fashion, rather than the more typical teamwear products.

Looking ahead to Q4, I’d spotlight seasonal and fun products. Life is challenging for most of us and we all need cheering up at an accessible price point. Primark seem to be really good at this. Halloween also still appears to be massive and I think licensors need to be more creative with designs that maximise those social media moments.

Ben Townsend, Product Development Executive, Aardman

There are a few trends that come to mind, but the one that really stands out to me is the reimagining of classic brands to reach entirely new audiences.

While in Florida for my honeymoon this year, I was struck by how many vintage – and often quite niche – Disney characters had been revived through bold, distinctive design choices. It felt like a renaissance for these legacy IPs, transforming them from ‘vintage’ into modern pop-culture icons. The styling was so strong that I found myself buying shirts featuring characters I didn’t even recognise, simply because the designs were fun, fresh and visually compelling. This trend speaks to the power of design in reshaping perception and focusing on the emotional engagement. It’s not just about nostalgia anymore – it’s about reinvention and image for a whole new audience.

2025 has also marked a cultural high point for Asian-led consumer products – both in terms of distinctive style and the variety of offerings. Labubu continues to thrive, and I believe plush keyrings will be Q4’s standout seller. The trend has swept the market, with many brands attempting to emulate Labubu’s success, and there’s strong potential for festive season sales to surge.

Building on this momentum, blind boxes are another format gaining lots of traction across multiple retailers in the UK. They tap into the excitement of collectability and mystery, which resonates strongly with today’s consumers.

Lastly, in the context of the cost-of-living crisis, we’re seeing a renewed appetite for nostalgia and comfort. Classic brands are being reinterpreted as pop culture icons, reaching new audiences and offering a sense of familiarity in uncertain times.

Enter your details to receive Brands Untapped updates & news.